This column, in January, reported Optus executives have considered several divestments over the past two years to help Singtel take some money off the table.

Dragging down group results

Singtel is weighing the divestment after its December quarter net profit dropped 12.5 per cent to $S465 million, which the group attributed to a “higher net exceptional loss mainly from Optus and Airtel”.

Optus reported $S1.8 billion ($2 billion) operating revenue for the December quarter, down 5.4 per cent over the same period in 2022. Its earnings before interest, tax, depreciation and amortisation dropped 1.8 per cent to $S465 million. Accounting for currency fluctuations, however, December quarter EBITDA was up 1.7 per cent, the Singtel accounts showed.

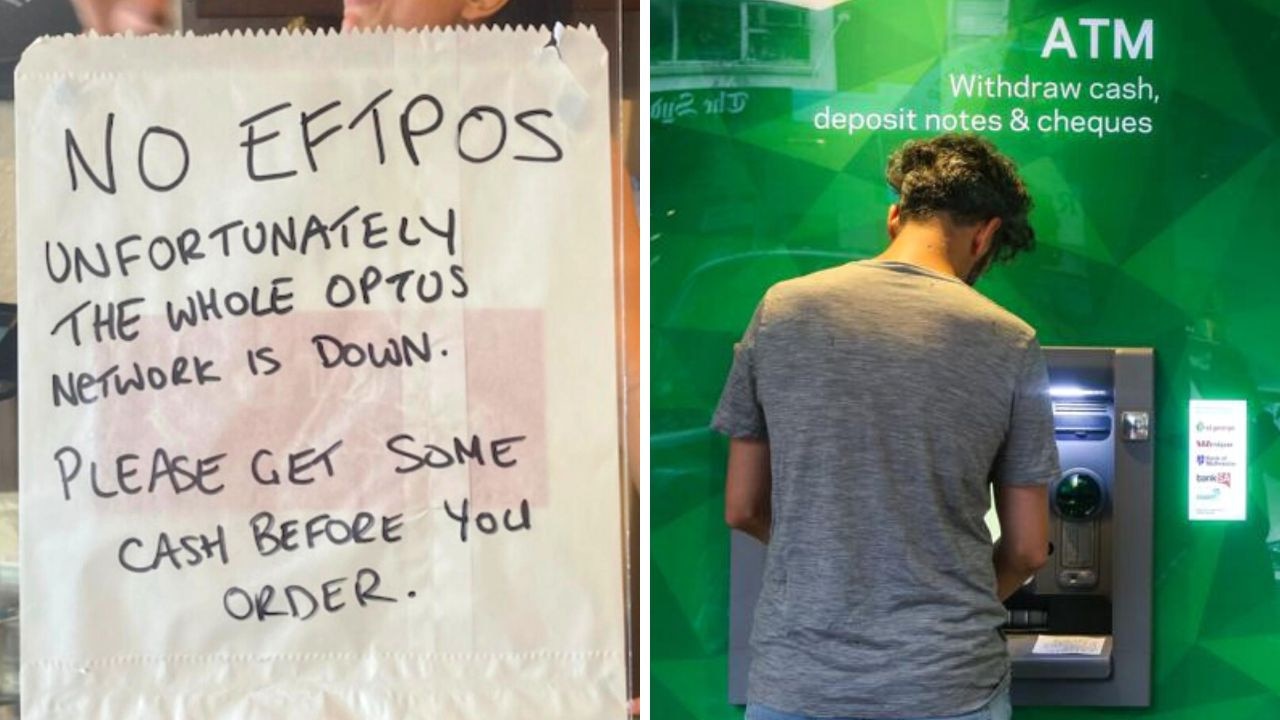

While rival Telstra has claimed to have picked up tens of thousands of Optus mobile customers after the outage, Optus’ revenue from selling mobile services still rose 3.4 per cent to $996 million over the quarter. It has about 10.5 million mobile customers.

Singtel is known to be close to Bank of America. In 2021, BofA’s bankers ran an auction for a 70 per cent stake in Singtel’s Australian Tower Network, which was primarily leased to Optus. AustralianSuper won the auction, valuing the towers at $2.3 billion. Of note, Brookfield was among the parties that took a look.

As for the Canadian, it is no stranger to telecommunication assets, especially towers. In 2019, it acquired 13,000 towers in India from Reliance Jio with a $US3.4 billion equity cheque. Just last month, it signed a $US2.5 billion deal to become the country’s largest telco tower operator buying American Tower Corp’s Indian operations.