By Daniel Foelber, The Motley Fool

Publication Date: 2026-01-20 15:07:00

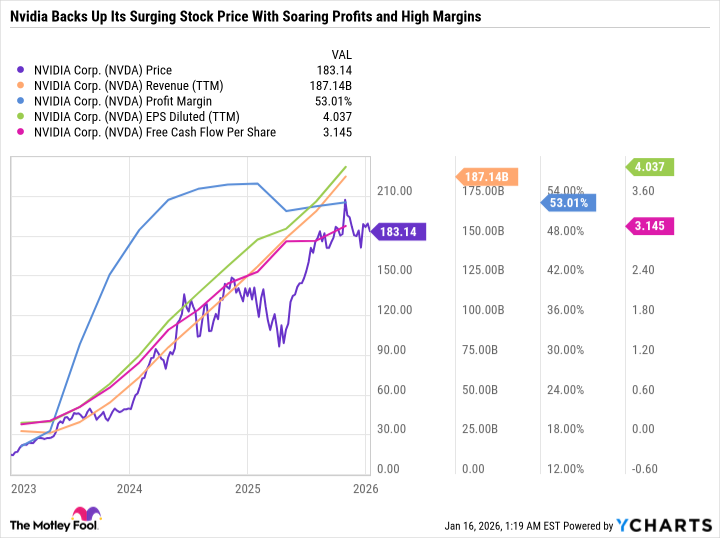

Nvidia is already the most valuable company in the world, but it could soon become the most profitable, too.

Nvidia (NVDA 3.02%) and fellow “Magnificent Seven” stocks Alphabet (GOOG 1.56%) (GOOGL 1.59%), Apple (AAPL 1.73%), Microsoft (MSFT 1.26%), Amazon (AMZN 2.05%), Meta Platforms (META 1.78%), and Tesla (TSLA 2.71%) have increased in value in recent years by so much that they now make up over a third of the total market capitalization of the S&P 500 (^GSPC 1.19%).

The five largest Magnificent Seven stocks by market cap also generate the most net income among U.S. companies, having matured from revenue-driven growth stories into highly profitable cash cows.

Here’s why Nvidia, which is currently the fourth-most profitable U.S. company, can surpass Microsoft, Apple, and Alphabet by net income within the next two years, and why the stock is a buy now.

Image source: Getty Images.

Nvidia is breaking records

Nvidia finished 2022 at a split-adjusted price of $14.61 per share and a market cap of $359.5 billion. Exactly three years later, Nvidia closed out 2025 with a share price of $186.50 and a market cap of $4.5 trillion.

Nvidia hasn’t just delivered for its shareholders — it has reshaped markets, with the stock making up a staggering 16.6% of the tech sector, 13.3% of the Nasdaq-100, and 7.1% of the S&P 500.

Normally, such a drastic surge in a relatively short period of time is cause for concern. But Nvidia is unrecognizable from where it was three years ago.