By Luke Lango

Publication Date: 2025-11-23 13:55:00

Just a few days ago, Nvidia (NVDA) delivered some of the most impressive earnings results we’ve seen all season…

Record revenue of $57.0 billion, +22% quarter-over-quarter (QoQ) and +62% year-over-year (YoY)…

And record data center revenue of $51.2 billion, +25% QoQ and +66% (YoY).

Plus, CEO Jensen Huang couldn’t have been more enthusiastic during the company’s quarterly call.

“Blackwell sales are off the charts, and cloud GPUs are sold out… Compute demand keeps accelerating and compounding across training and inference – each growing exponentially. We’ve entered the virtuous cycle of AI. The AI ecosystem is scaling fast – with more new foundation model makers, more AI startups, across more industries, and in more countries. AI is going everywhere, doing everything, all at once.”

Initially, the Street reacted positively to this blockbuster report – but that enthusiasm was quickly replaced by investors’ overwhelming skepticism.

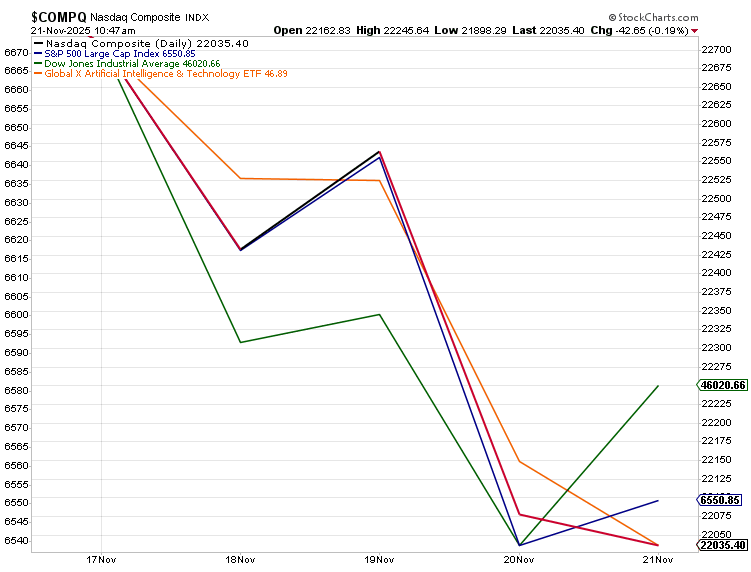

After a few short hours of gains, stocks sold off sharply – and they’ve largely been floundering ever since… especially AI stocks.

So, let’s unpack Wall Street’s freakout, shedding light on why some of those worries are real – but manageable – and, most importantly, why we still think this is a buy-the-fear moment for AI stocks…

Nvidia’s Quarter: Record-Breaking Results Across the Board

First, the facts – for its fiscal Q3 2026, Nvidia reported:

- Revenue:…