CasarsaGuru

Nutanix’s (NASDAQ:NTNX) share price has suffered in recent months, due in large part to weak guidance on the third quarter earnings call. Cooling investor sentiment in regard to potential downstream beneficiaries may also have contributed to weakness.

The last time I wrote about Nutanix, I stated that its business was proving resilient, despite the difficult macro environment. While Nutanix’s valuation at the time left considerable room for upside, I felt that consistent growth and a transition would be needed for investors to become more positive about the company’s prospects.

Despite the recent pullback, Nutanix valuation is now more demanding, meaning that the company needs to avoid a continued growth deceleration. I remain fairly bullish about Nutanix’s long-term prospects though. The company continues to have an extremely high net promoter score and low churn, which will result in high margins as the business matures. The expansion of Nutanix’s product portfolio and market share gains should also ensure growth remains healthy for a long period of time.

There could also be tailwinds from AI and Broadcom’s (AVGO) acquisition of VMWare, although this will likely take time to feed through to the company’s financials. I think this may largely be outweighed by demand headwinds in the near term though.

Market Conditions

Nutanix’s sales cycles remain elongated, and this situation is expected to persist into the fourth quarter. The demand environment obviously remains challenging, but some of this could be due to Nutanix’s platform becoming more strategic in nature for customers.

While demand may currently be muted, customers still need to modernize their infrastructure and improve the efficiency of their data center footprint. It is probably too early to say definitively, but AI should accelerate the shift towards modern applications, supporting demand for Nutanix’s solutions.

A hardware refresh is typically needed to shift to an HCI architecture though, which can slow adoption in some cases, as customers may choose to wait until their hardware is fully depreciated. This may have been something of a tailwind over the last 12-18 months though, due to the hardware backlog created by COVID supply chain disruptions.

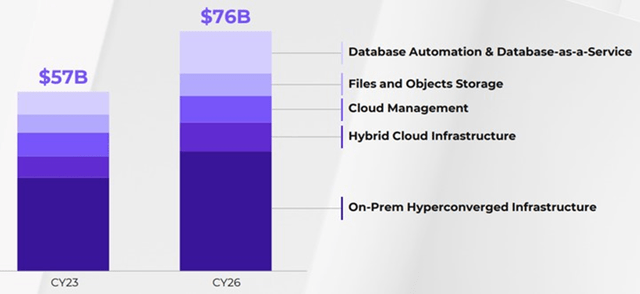

Nutanix expects its total addressable market to total $76 billion by FY2027. While this will still be dominated by on-prem hyperconverged infrastructure. There is a growing opportunity in areas like database automation that Nutanix is well positioned to capitalize on. This provides Nutanix with a long growth runway, provided it remains competitive.

Figure 1: Nutanix Total Addressable Market (source: Nutanix)

Nutanix’s competitive positioning has likely benefited from Broadcom’s acquisition of VMWare, in large part due to Broadcom increasing prices pulling back on investments in product development. Nutanix has suggested that this opportunity will take time to play out though due to the fact that many VMware customers signed multiyear ELAs prior to the acquisition. A lot of VMWare’s installed base will also require a hardware refresh to run HCI.

While list prices have increased significantly, Broadcom has shown a willingness to price aggressively when at risk of losing a large customer. As a result, the opportunity may be more amongst smaller customers. Nutanix has suggested that its conversion rate on smaller deals has been steady in recent quarters.

Nutanix Business Updates

Nutanix’s business is based around trying to abstract IT complexity for users, with a growing focus on storage and databases. This enables Nutanix to capitalize on CIO priorities like:

- Modernizing infrastructure

- Running modern apps and AI

- Enabling multi-cloud deployments

- Enabling portable apps

Nutanix’s software also enables:

- Migration of workloads to the cloud

- Disaster recovery

- Management of demand fluctuations (seasonal demand and geographic expansion)

Project Beacon is illustrative of Nutanix’s desire to capture more value. It is an initiative that aims to deliver a portfolio of data-centric IaaS and PaaS services, including fully managed services, across deployment environments. Containers and Kubernetes have made applications portable, but the platform services used to manage the data are tied to specific clouds. Nutanix wants to decouple applications and their data from the underlying infrastructure, helping developers to build applications once and run them anywhere.

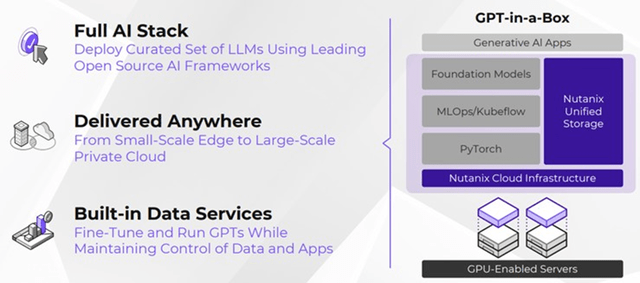

Nutanix also recently announced GPT in-a-box 2.0, which will deliver expanded GPU and LLM support. GPT in-a-box helps with the configuration and management of inferencing hardware and simplifies model management. Nutanix has suggested that there is a high level of interest in GPT in-a-box and that it is driving additional wins.

Nutanix also recently entered into a partnership with Hugging Face to provide access to the Hugging Face library of LLMs and expanded its partnership with NVIDIA, including the planned integration of NVIDIA’s NIM inference microservices with GPT in-a-box. The goal of the partnership is to help customers to build scalable and high-performance GenAI applications. NIM microservices provide optimized inference on a range of popular models.

Figure 2: Nutanix GPT-in-a-Box (source: Nutanix)

Nutanix also recently partnered with Dell, with Dell offering an appliance that combines Nutanix Cloud Platform and Dell servers. The partnership will allow customers to replace their hypervisor while reusing existing storage, creating an on ramp for HCI. VMware has historically been a Dell subsidiary/partner, so the partnership could help Nutanix to take market share from VMWare. If nothing else, it should help to accelerate the shift of customers over from legacy architectures

Nutanix also has a partnership with Cisco that aims to accelerate hybrid multi-cloud adoption and is expected to provide a growing contribution going forward. The companies have an offering which integrates Cisco’s SaaS-managed compute and networking infrastructure with the Nutanix Cloud Platform.

Financial Analysis

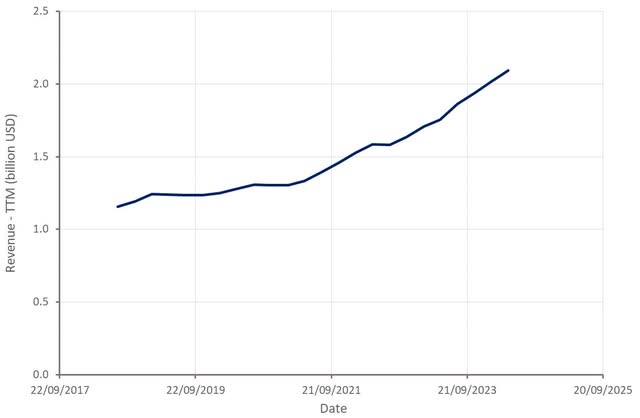

Nutanix generated $525 million of revenue in Q3, an increase of 17% YoY. ARR was up 24% to $1.82 billion, while ACV billings increased 20% YoY to $288.9 million. Revenue, ACV billings and ARR growth will eventually converge, although this will likely come from a moderation in ACV and ARR growth as much as from revenue growth acceleration.

Nutanix is seeing a greater mix of large deals in its pipeline at the moment. The number of opportunities with over $1 million in ACV in Nutanix’s pipeline has grown at more than 30% YoY for each of the last three quarters. The total dollar value of these opportunities has also grown at more than a 50% YoY rate for each of the last three quarters. While this is obviously a positive, these deals tend to be more strategic decisions, leading to greater scrutiny and longer deal cycles. Competition can also be fierce and there is more variability in outcome and timing.

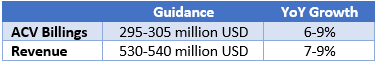

Nutanix’s guidance suggests that growth will drop into the high single digits in the fourth quarter. While I believe that this guidance is conservative, I still think there will be a material growth deceleration in the fourth quarter that will persist into FY2025. This could be problematic for Nutanix, as I don’t think investors have enough confidence in the business yet to assign a high revenue multiple when growth is in the low to mid-teens.

Table 1: Nutanix Q4 FY2024 Guidance (source: Created by author using data from Nutanix)

Figure 3: Nutanix Revenue (source: Created by author using data from Nutanix)

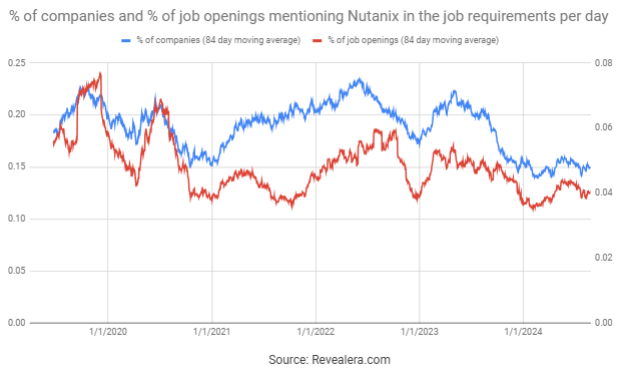

The number of job openings mentioning Nutanix in the job requirements points towards a weak demand environment, with little to suggest that growth will reaccelerate in the near-term. This is potentially complicated by the fact that demand is likely to be more dependent on a relatively small number of larger organizations going forward.

Figure 4: Job Openings Mentioning Nutanix in the Job Openings (source: Revealera.com)

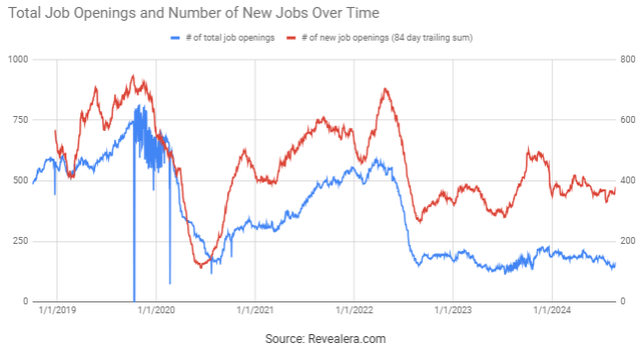

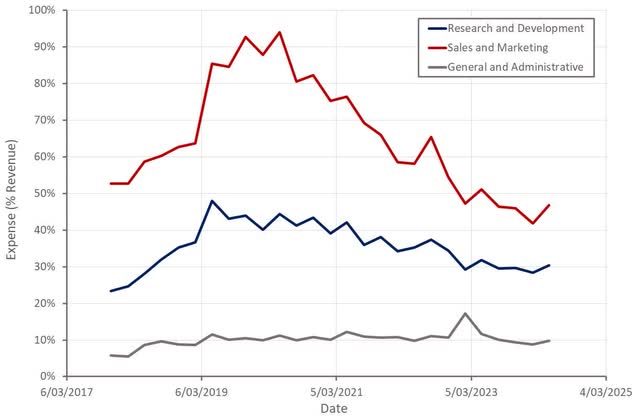

The number of Nutanix job openings also suggests that the demand environment remains soft. Nutanix’s business transformation has meant that it has been growing into its cost base over the past few years as it shifts from hardware to software revenue, and from license to subscription revenue. Continued growth should see an uptick in hiring at some point though.

Figure 5: Nutanix Job Openings (source: Revealera.com)

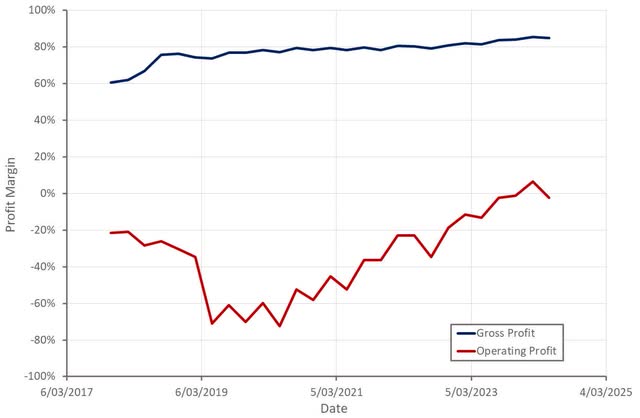

Nutanix’s non-GAAP gross margin was 86.5% in the third quarter. The company’s gross margins are extremely strong given the growing proportion of subscription revenue and the nature of the company’s products.

Nutanix’s non-GAAP operating margin was 14% in Q3, which the company attributed to a combination of lower operating expenses, higher gross margins and operating leverage. OpEx benefitted from a $40 million non-recurring cash payment related to Nutanix’s partnership agreements.

Nutanix’s margins have trended higher over the past five years, and the company should soon be consistently profitable on a GAAP basis. Nutanix is already cash flow positive and generating fairly strong free cash flow margins. Ultimately, I expect the company to have fairly strong operating margins (~30%), largely on the back of low churn.

Figure 6: Nutanix Profit Margins (source: Created by author using data from Nutanix)

Figure 7: Nutanix Operating Expenses (source: Created by author using data from Nutanix)

Conclusion

While Nutanix’s share price has moved significantly higher over the past 12 months, the company has never really captured the imagination of investors. This could eventually change if Broadcom’s acquisition of VMWare reduces competition, and AI creates a sustained tailwind.

Nutanix’s EV/S ratio is sitting near the upper end of its historical range, and as a result, I don’t believe there is much room for further multiple expansion, unless Nutanix can meaningfully accelerate its growth. Analysts currently expect $2.46 billion of revenue in FY2025, representing roughly 15% growth, in line with the prior year.

There has been anticipation of a broad-based growth reacceleration amongst software companies for the better part of a year, although there has been little evidence of this so far. Nutanix’s commentary around large and expanding opportunities and pipeline strength are promising, but the company’s growth appears set to further moderate due to macro headwinds. As a result, I think that while Nutanix’s stock is likely to perform well longer term, this is offset by limited near term upside and the risk of disappointing FY2025 guidance.

Figure 8: Nutanix EV/S Ratio (source: Seeking Alpha)

Article Source

https://seekingalpha.com/article/4717096-nutanix-fy2025-guidance-is-crucial