Nutanix NTNX reported fourth-quarter fiscal 2024 non-GAAP earnings of 27 cents per share, which surpassed the Zacks Consensus Estimate by 35% and increased 12.5% year over year.

Nutanix’s revenues climbed 11% year over year to $548 million, beating the Zacks Consensus Estimate by 2.02% and the guided range of $530-$540 million.

The top line was primarily driven by growth in NTNX’s core hyper-converged infrastructure software and the solid adoption of its new capabilities. Nutanix continues to witness a strong adoption of its hybrid multi-cloud solutions across Fortune 100 and Global 2000 companies.

NTNX noted that the average contract term length in the fiscal fourth quarter was 3.1 years, 0.1 years higher than the fiscal third quarter.

During the fiscal fourth quarter, Nutanix’s Annual Contract Value (ACV) billings jumped 21% to $338 million, which was above the guided range of $295-$305 million.

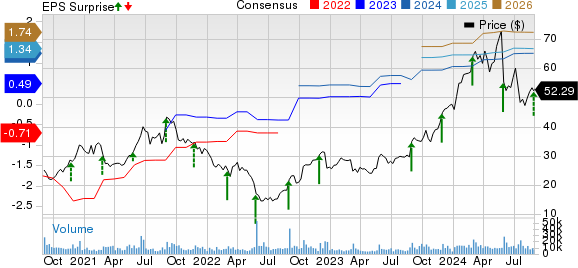

Nutanix Price, Consensus and EPS Surprise

Nutanix price-consensus-eps-surprise-chart | Nutanix Quote

Top-Line Details of NTNX

Product revenues (48.5% of total revenues) increased 10.6% year over year to $265.9 million. Support, entitlements & other services revenues (51.5% of total revenues) rose 11.2% to $282.05 million.

Subscription revenues (94.7% of total revenues) climbed 12.9% from the year-ago quarter’s figure to $518.7 million. Professional services revenues (4.9% of total revenues) improved 11.4% to $26.7 million. Other non-subscription product revenues (0.5% of total revenues) decreased 76.8% to $2.49 million.

Billings were up 23.5% year over year to $672.86 million. Annual recurring revenues climbed 22% to $1.91 billion.

During the fiscal fourth quarter, Nutanix added 670 customers, taking the total number of clients to 26,530.

The company’s largest win in the fiscal fourth quarter was a multimillion-dollar ACV deal with a North American-based Fortune 100 financial services company, which replaced its existing solution with the Nutanix Cloud platform, including AHV hypervisor as well as Nutanix cloud manager.

Operating Details

In the fiscal fourth quarter, Nutanix’s non-GAAP gross margin expanded 110 basis points year over year to 86.9%.

Non-GAAP operating expenses increased 12% year over year to $405.5 million.

Non-GAAP operating income came in at $70.5 million compared with $63.3 million reported in the year-ago quarter.

Balance Sheet & Cash Flow

As of July 31, 2024, cash and cash equivalents plus short-term investments were $994.3 million, down from $1.44 billion at the end of the third quarter of fiscal 2024.

During the fourth quarter of fiscal 2024, cash generated through operating activities was $244.7 million and free cash flow was $224.3 million.

Outlook

For the first quarter of fiscal 2025, revenues are estimated between $565 million and $575 million. Non-GAAP operating margin is expected in the band of 14.5-15.5%. The company expects fully diluted weighted average shares outstanding of approximately 287 million shares.

For fiscal 2025, revenues are estimated in the range of $2.435-$2.465 billion, indicating year-over-year growth of 14% at the midpoint. The company expects free cash flow in the range of $540-$600 million, suggesting a free cash flow margin of 23% at the midpoint.

Non-GAAP operating margin is expected in the band of 15.5-17%.

Zacks Rank & Key Picks

Nutanix carries a Zacks Rank #3 (Hold) at present.

Some better-ranked stocks from the broader Computer and Technology sector are Arista Networks ANET, Badger Meter BMI and Audioeye AEYE, each sporting a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Arista Networks’ shares have rallied 46.8% in the year-to-date period. The long-term earnings growth rate for ANET is anticipated to be 17.2%.

Badger Meter’s shares have gained 32.5% in the year-to-date period. The long-term earnings growth rate for BMI is projected at 17.91%.

Shares of Audioeye have surged 342.6% in the year-to-date period. The long-term earnings growth rate for AEYE is expected to be 25%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Badger Meter, Inc. (BMI) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report

Nutanix (NTNX) : Free Stock Analysis Report

Audioeye, Inc. (AEYE) : Free Stock Analysis Report

Article Source

https://finance.yahoo.com/news/nutanix-q4-earnings-surpass-estimates-124800610.html