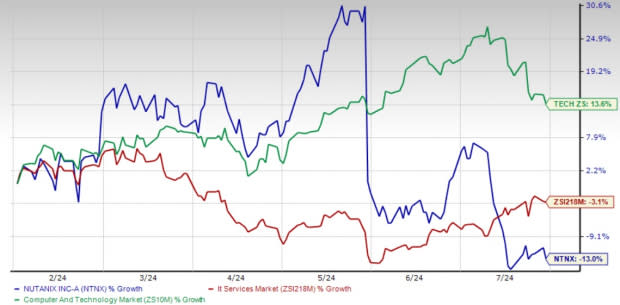

Nutanix NTNX, a prominent player in the hybrid multi-cloud computing space, has experienced a 13% decline in its stock price over the past six months, underperforming the Zacks Computer and Technology sector’s return of 13.6%. This decline has left investors questioning the company’s future prospects. This downturn occurs against a backdrop of broader tech sector volatility and macroeconomic uncertainties.

Despite the recent stock performance, Nutanix has shown resilience in its core business. The company’s third-quarter fiscal 2024 results demonstrated continued revenue growth and an expanding customer base, suggesting that its fundamental value proposition remains strong. Nutanix’s focus on hyperconverged infrastructure and its transition to a subscription-based model have been key drivers of its business strategy.

6-month Performance

Image Source: Zacks Investment Research

Examining Nutanix’s Potential in a Shifting Cloud Landscape

At the forefront is Nutanix’s strong position in the rapidly growing hybrid cloud market. As enterprises increasingly adopt multi-cloud strategies, Nutanix’s hyperconverged infrastructure solutions are well-positioned to meet this rising demand. The company’s ability to provide seamless integration between on-premises and cloud environments gives it a competitive edge in a market that shows no signs of slowing down.

Nutanix’s transition to a subscription-based revenue model is another factor working in its favor. While this shift may have initially impacted short-term financials, it promises more predictable and stable long-term revenue streams. This transition aligns with broader industry trends and could lead to improved investor confidence as the model matures.

The company’s expanding customer base is a testament to the value of its offerings. Despite market challenges, Nutanix has consistently grown its client roster, indicating strong product-market fit and customer satisfaction. This growing user base not only provides a stable revenue foundation but also offers opportunities for upselling and cross-selling as Nutanix expands its product portfolio.

For fiscal 2024, NTNX expects ACV billings between $1.12 billion and $1.13 billion. The Zacks Consensus Estimate for fiscal 2024 ACV billings is pegged at $1.14 billion, which indicates 19.1% growth year over year.

Innovation remains a key driver for Nutanix’s potential growth. The company continues to invest heavily in research and development, focusing on emerging technologies such as edge computing, AI and advanced analytics. These investments could yield new products and features that differentiate Nutanix from competitors and open up new revenue streams.

Financial resilience is another factor to consider. Despite the stock price decline, Nutanix has maintained steady revenue growth, demonstrating the underlying strength of its business model. As the company continues to scale, there’s potential for margin improvement, which could positively impact profitability and stock performance.

Nutanix expects fiscal 2024 revenues to be in the range of $2.13-$2.14 billion. The Zacks Consensus Estimate for fiscal 2024 revenues is pegged at $2.14 billion, which suggests 14.77% year-over-year growth. The consensus mark for earnings is pegged at $1.22 per share, which implies a 103.33% increase.

Image Source: Zacks Investment Research

Strategic partnerships with major cloud providers have expanded Nutanix’s reach and capabilities. These alliances not only enhance the company’s product offerings but also provide access to larger customer bases and new market segments.

Nutanix announced a collaboration with NVIDIA NVDA aimed at helping enterprises more easily adopt generative AI (GenAI), which includes new functionality for Nutanix GPT-in-a-Box, including integrations with NVIDIA NIM inference microservices and the Hugging Face Large Language Models library. The company’s collaboration with Dell Technologies DELL is aimed at accelerating customers’ digital transformation journeys fueled by infrastructure modernization and modern application development.

Nutanix’s Dual Challenge: Rivalry and Rich Valuation

However, challenges persist. Intensifying competition from established players and cloud giants could pressure Nutanix’s market share and margins. Key rivals include VMware, Dell Technologies and Hewlett Packard Enterprise HPE, all of which offer similar solutions for hybrid and multi-cloud environments. Additionally, public cloud giants like Amazon Web Services, Microsoft Azure and Google Cloud Platform pose indirect competition as enterprises increasingly shift workloads to the cloud.

Valuation-wise, the company’s trailing 12-month EV/EBITDA ratio of 55.69 is ahead of the Zacks Computers – IT Services industry average of 49.88. This premium valuation is partly justified by Nutanix’s strong revenue growth and successful transition to a subscription-based model. However, it also leaves the stock vulnerable to market volatility and any perceived slowdown in the company’s expansion.

NTNX’s EV/EBITDA TTM Ratio Depicts Stretched Valuation

Image Source: Zacks Investment Research

Conclusion

Despite the competitive landscape, Nutanix’s strong position in the growing hybrid cloud market and expanding customer base suggest that it may be premature to abandon the ship. New investors should wait for a better entry point for Nutanix, which currently has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

As we look into the future, several key indicators will be important for investors to monitor. These include Nutanix’s customer retention rates, the pace of new customer acquisitions and the company’s success in upselling existing clients to higher-value solutions. Additionally, Nutanix’s ability to innovate and expand its product portfolio will be critical in maintaining its competitive edge. Investors should closely analyze the upcoming financial results and management guidance to gauge the company’s progress and future potential.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Dell Technologies Inc. (DELL) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Hewlett Packard Enterprise Company (HPE) : Free Stock Analysis Report

Nutanix (NTNX) : Free Stock Analysis Report

Article Source

https://finance.yahoo.com/news/nutanix-ntnx-down-13-6-141400132.html