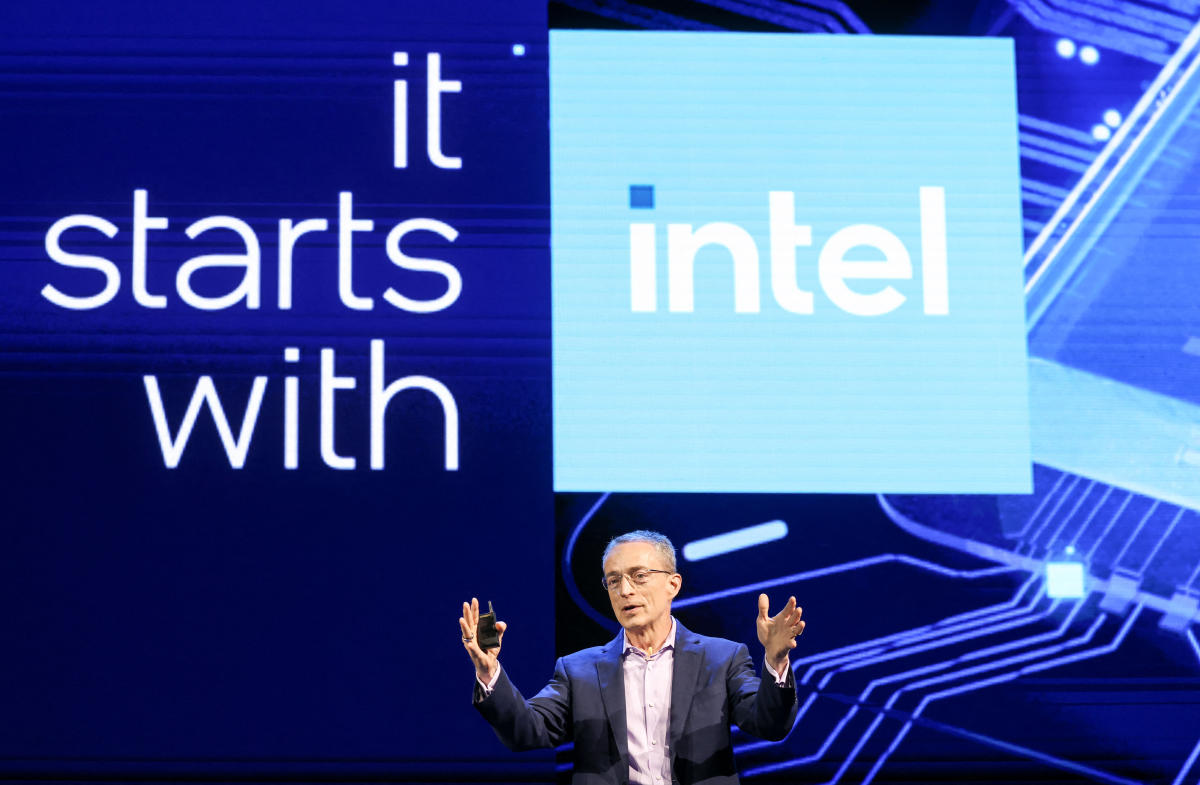

Intel’s stock was the top trending stock in premarket trading on Tuesday after Melius Research identified the company as a top contender for the AI “catch-up” trade later in 2024. This news caused Intel’s shares to rise more than 6% to a two-month high on Monday, with a 2.4% increase in premarket trading. Melius Research suggested that Intel, along with Advanced Micro Devices (AMD), Apple (APL-American Lead Association), and others, could start catching up with AI leaders like Nvidia (NVDA) in the second half of the year.

Analyst Ben Reitzes from Melius Research mentioned a potential “catch-up” trade in the semiconductor, hardware, and software sectors for companies with lower expectations. Mizuho Securities analyst Jordan Klein noted that there was short-covering happening in chipmakers like Intel. However, Klein also stated that long-term investors may not be interested in buying Intel, and a significant rally beyond $30 in the coming months is unlikely.

Intel’s share price received a boost due to anticipation around upcoming processors that could strengthen the company’s position in the AI and gaming hardware market. The company is gearing up to launch a new graphics processing unit (GPU) manufactured by Taiwan Semiconductor Manufacturing (TSM).

In other news, Chipotle’s stock split excitement seemed to fade as the company fell more than 5% in Monday’s session. The company’s stock split was one of the largest in the history of the New York Stock Exchange, with shares dropping from over $3,200 to $59 after the split. Despite the downgrade from Wedbush to “neutral,” other analysts maintained positive ratings for Chipotle with price targets ranging from $3,200 to $3,600.

BP announced that it expects to post a second-quarter impairment of up to $2 billion and warned of a hit to its oil trading profits. This news came amid weak refining margins and lower oil trading performance. Rival energy giant Shell also announced an after-tax impairment of up to $2 billion, primarily linked to its Singapore and Rotterdam plants.

Wizz Air expects further delays in Airbus deliveries but remains confident in its ability to increase capacity in the coming years. The budget carrier is dealing with grounded planes for inspections and anticipates limited impact from the delivery delays. Airbus recently cut its targets due to continued supply disruptions.

Overall, the stock market saw fluctuations and impacts from various factors such as company performance, oil market conditions, and supply chain disruptions. Investors are closely monitoring these developments and adjusting their strategies accordingly.

Article Source

https://uk.finance.yahoo.com/news/intel-chipotle-bp-wizz-air-trending-tickers-083121206.html