By Keithen Drury, The Motley Fool

Publication Date: 2026-02-08 00:58:00

Intel stock may have bounced back in 2025, but I’m betting on the chip industry’s best in 2026.

One tech company that investors have bet on to turn it around is Intel (INTC +4.91%). Intel was a key computing innovator during the early 2000s, but it has slowly lost its edge. Its foundry business, which other chip design companies can contract with to produce their chips, is struggling to find large clients. However, late in 2025, Intel got a lifeline.

Investors are excited that Nvidia (NVDA +8.01%) has purchased a $5 billion stake in Intel and will be collaborating with it on a host of products — a plan that will also involve Nvidia embedding Intel’s central processing units (CPUs) into some of its computing units. Intel’s stock has been on fire as a result, and is now up by more than 100% since the day before that deal was announced in September. While I’m cheering for the prospect of an Intel turnaround, I think investors would still be better off scooping up shares of Nvidia.

Image source: Getty Images.

Intel’s stock isn’t cheap

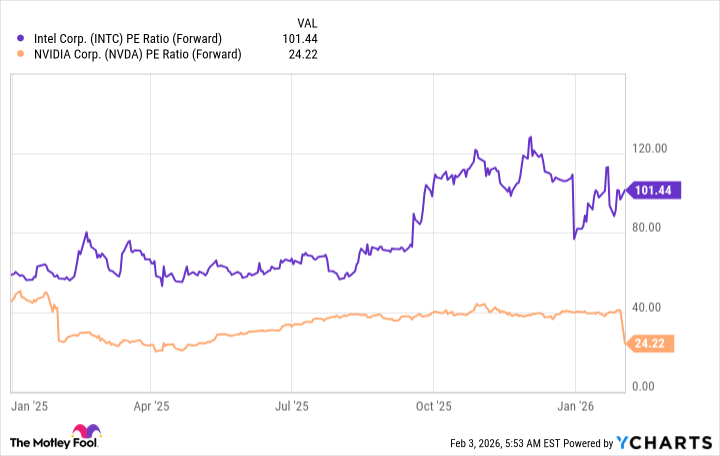

Part of the reason why investors were excited about Intel’s stock for so long was how relatively cheap it was. However, that description no longer fits. Right now, Intel trades for more than 100 times forward earnings. Nvidia is far cheaper at 24 times forward earnings.

INTC PE Ratio (Forward) data by YCharts.

The market is clearly excited about Intel’s turnaround prospects and is willing to give it the benefit of the doubt, even if revenue…