Businesses and customers are rallying against the big banks and pushing to keep physical money in circulation, instead of forcing Australians to pay via cards.

Almost 150,000 people have now signed an online petition, arguing a cashless economy is unreliable and costs businesses thousands of dollars every year in fees.

WATCH THE VIDEO ABOVE: Business and customers push to keep cash alive.

Looking for a new job or job candidate? Post jobs and search for local talent on 7NEWS Jobs >>

Cash Welcome campaign coordinator Jason Bryce told Sunrise that “businesses need to be able to accept cash”.

Bryce estimated it costs businesses “thousands” every month to operate EFTPOS.

“Just one EFTPOS terminal is like $200 a month,” he said.

“Cash is surcharge-free, people understand cash and will budget with cash, will save with cash.

“And some people use cash and rely on cash every single day, and it’s just getting too hard to get.

“Bank branches are closing, ATMs are closing, as soon as there’s an outage we’re stuck. We’re not in control of our information.

“Our economy isn’t inclusive anymore, and our petition is just asking the government to have a look at this, to say ‘look what’s going on with our access to cash’.

“This is national economic infrastructure, we all need cash sometimes and a lot of people need cash every single day.”

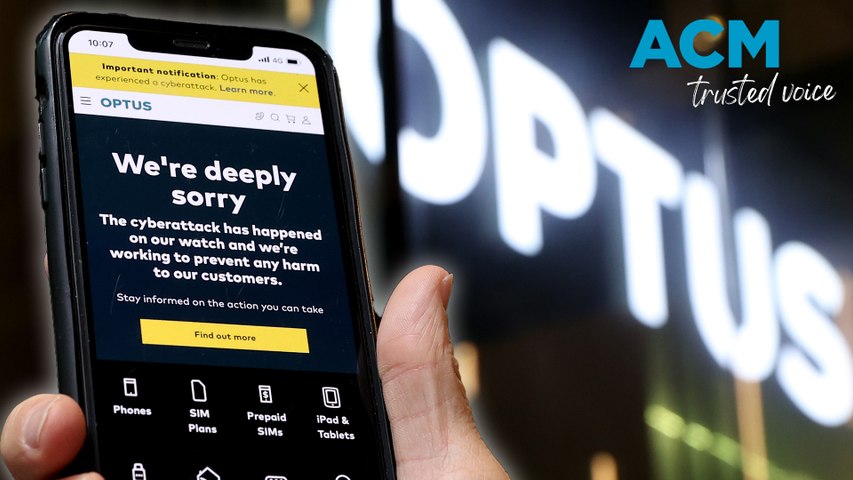

Bryce said the Optus outage was “a big wake-up call” to many.

The 12-hour outage left 10 million individuals and businesses high and dry last Wednesday, unable to make or receive calls, or complete transactions.

However, Bryce said concerns have been building for some time.

“There are often issues with EFTPOS and we’re left dealing with cash,” Bryce said.

“Young people, old people, prefer cash. Sure, lots of people like to tap-and-go, but there are some times when we all need to use cash and some people use cash every single day.

“They rely on (cash), they trust it and we’re just asking the government to make sure that we can access cash in our local community and we can use cash to buy food and groceries.”

Bryce said at the end of the day it comes down to choice, and every Australian deserves the option to pay electronically or with physical money.

It comes after Australia’s big four banks said they were committed to providing cash services to customers, despite some branches no longer offering over-the-counter transactions.

Commonwealth Bank in July week announced cash would no longer be available over the counter at a number of branches as the major bank shifted to “specialist centres” that support customers with “more complex banking needs”.

The move followed ANZ also scrapping over-the-counter cash transactions in some branches earlier this year, citing a dramatic fall in demand for in-branch transactions.

Customers have made an overwhelming shift to digital, with 98.9 per cent of total banking transactions made online and via apps last year, according to the Australian Banking Association.

ABA research also showed that in-person branch transactions fell 46 per cent in the last financial year.

The Reserve Bank of Australia’s latest consumer payments survey released this month also found Australians are using cash less frequently in day-to-day transactions, with only about 13 per cent of payments made using cash last year — compared to about 70 per cent of payments in 2007.

Despite this shift, community advocates are concerned that stopping over-the-counter cash transactions will exclude people who may rely on them.

“Senior citizens, new migrants, people who are disabled, they do need face-to-face help, there’s a danger here of excluding some elements of our society,” Swinburne University technology professor Steve Worthington told 7NEWS earlier.